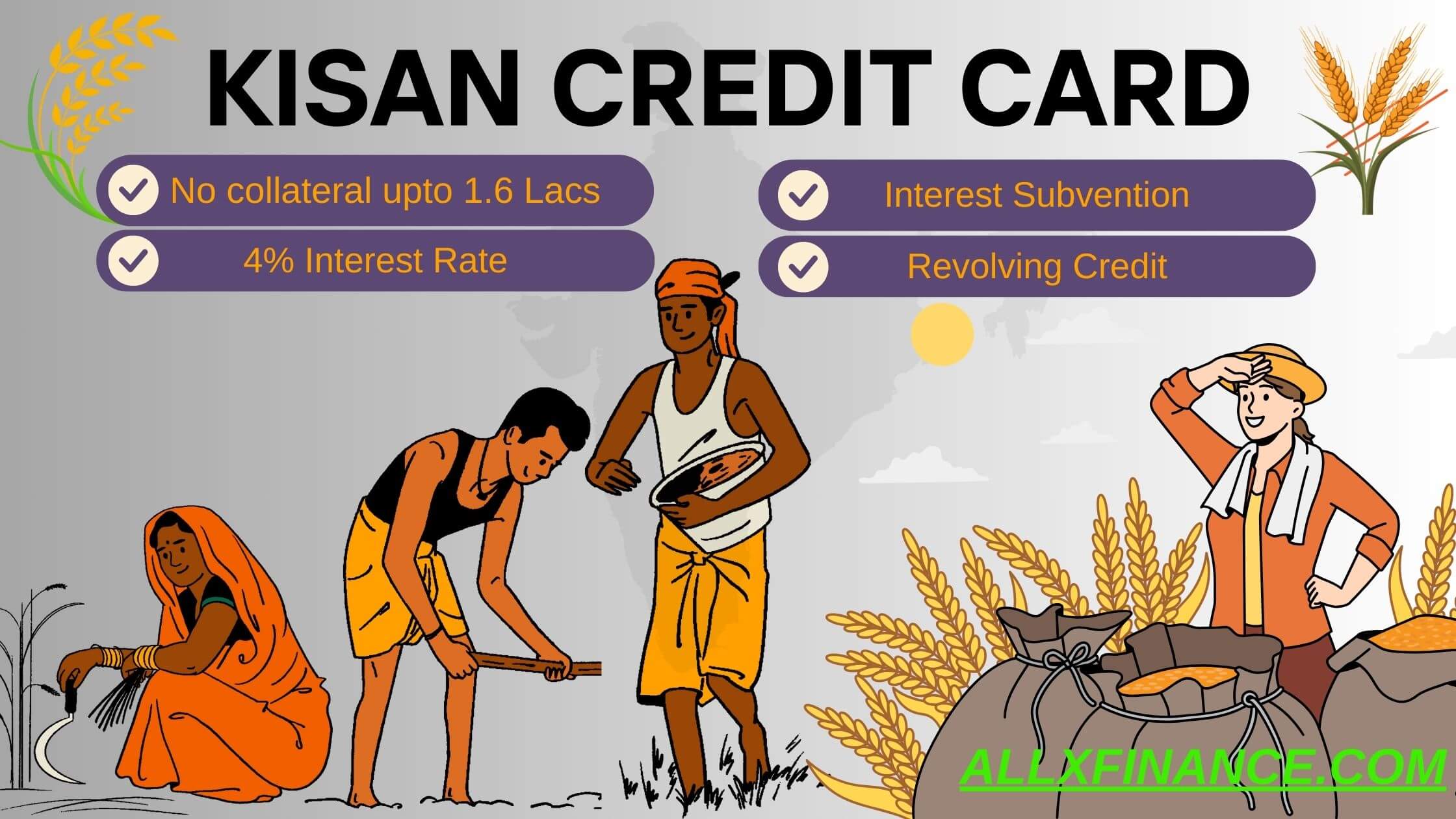

Kisan Credit Card is a scheme for farmers to meet their financial needs in daily agricultural operations. KCC is a subsidy-based loan where Govt provides interest subvention of 3%, subject to rotation of funds through account annually. India is proudly called an agricultural-based country, as we are the largest producer of wheat, rice, many fruits, dry fruits, etc. India’s economy highly depends on agriculture for production, distribution, and consumption. Despite this fact, the production rate per farmer is far less than needed.

To improve the production rate, the government has introduced various schemes from time to time. The most common and highly availed scheme among those is Kisan Credit Card (KCC).

The banks in India are given mandatory targets in priority sector lending. According to RBI’s directive, the loans in the agriculture sector should be at least 18% of the gross credit of banks.

We will discuss the common doubts people have related to Kisan Credit Card (KCC) loans. By the end, if you still have any questions, the comment section is open.

What is eligibility to avail Kisan Credit Card (KCC) or any agricultural loan?

An individual who wish to avail KCC loan from a bank must be a farmer who is directly involved in irrigation on either his own land or leased land. The land owned or taken on lease by farmer is verified from 7/12 extract or lease agreement respectively. Other requirements include, the applicant must have a saving account with the bank. The credit history (CIBIL) is also checked by bank. Ideally the score should be above 700 with satisfactory repayment record.

The minimum irrigated land required for Kisan Credit Card (KCC) loan is 2 acres and the maximum allowable limit is 1000 acres. Further the farmers are divided in 04 basic categories namely;

- Marginal Farmers : Those having less than 1 hectare= 2.47 Acre of land.

- Small Farmers : Those having 1 to 2 hectare of land.

- Medium Farmers: Those having 2 to 10 hectare of land.

- large farmers: Those having greater than 10 hectare of land.

Age criteria to avail Kisan Credit Card(KCC) is between 18 to 75 years of age. However, co borrower who is closely related or legal heir should be mandatorily taken with applicant having age greater than 60 years.

What are the documents required for Kisan Credit Card (KCC) or any agricultural loan?

Following set of documents are required for applicant;

- Passbook of Saving account

- Duly filled and signed application form.

- Passport Size Photograph

- Aadhaar Card

- Pan Card

- Loan statement of accounts with other banks

Following set of documents are required to verify land ownership or possession by lease deed;

- For owned Land:

- 7/12 extract and or similar land ownership document – This helps in identifying ownership type , total no. of owners and their share, cultivable and non-cultivable area in the property etc.

- 8 ‘A’ extract – This is a record provided the details like ownership, village, taluka, district area of land etc. as recorded in government records.

- For leased land:

- Lease deed/letter from appropriate govt authority/village authority as applicable.

- ‘Licensed Cultivator’s Eligibility Card (LCEC)’ (wherever applicable).

- In case of oral lease, a declaration to this extant to be obtained.

What is the interest rate applied in Kisan Credit Card (KCC) loans?

Kisan Credit Card(KCC) loans are primarily meant to support farmers throughout their irrigation cycle. These loans do have interest subvention as well. KCC availed up to INR 3.00 lacs attract a flat rate of 7% with an interest refund of 3% if the outstanding amount is fully paid within 12 months of availment. The borrowers only need to pay an interest of 4% after subvention.

For loans above INR 3.00 lacs, banks can apply a spread above MCLR. For example, if the current MCLR is 8.8%, the bank may add a spread of 2.5%, making the effective ROI 8.8+2.5= 11.3%.

What is the tenure of Kisan Credit Card (KCC)?

Normally banks keep the tenure of KCC loans for 05 years. However, banks are free to fix the tenure as per the harvesting marketing and selling cycle of the crops. The cards given in KCC is normally valid for 05 years.

Can I get loan for buying agriculture land?

Yes, many banks offers loans to small and marginal farmers for purchase of agricultural land. Few criteria bank need the applicant to fulfill are:

- Applicant should have agricultural background.

- Mortgage on existing agriculture land and proposed agriculture land to be purchased.

- Hypothecation of crops grown on the proposed land

Is mudra loan available for agriculture?

Yes, Mudra loan is available for agriculture sector. However, Kisan Credit Card(KCC) is a different product and cannot be mixed wit MUDRA loans.

What is agriculture loan waiver in India?

Farmers in distress are a major issue faced by ruling governments in the states and centers. Natural calamities leading to unfavorable production are major causes of farmers’ distress. The state and central governments provide aid through loan waivers to support these farmers. The state or the central government then pays the outstanding amount of the loan.

How much loan I can expect under Kisan Credit Card (KCC) scheme?

The limit for the first year is decided as ;

Scale of finance (SOF) X area cultivated +10% of limit towards post-harvest/household/consumption needs + 20% of limit towards repairs and maintenance expenses of farm assets and allied activities + crop insurance and/ or accidental insurance including PAIS, health insurance and asset insurance.

- Scale of Finance: It is the finance required to raise a crop per unit of cultivated area, i.e., an acre or hectare. The decision is made by the district-level technical committee based on various factors like harvesting pattern in the area, production in an acre, price of the agricultural produce in the market, etc.

Every year, the Kisan Credit Card(KCC) limit is raised by 10%, considering increased crop production expenses subject to annual review. The limit is renewed annually based on the interest fully paid and outstanding limit amount is zeroised. The 10% addition is done for 05 consecutive years, and in the fifth year, the Maximum permissible limit is achieved.

What does bank check during their visit of agricultural land?

What happen if someone defaults payment of a Kisan Credit Card (KCC) or agricultural loan?

Bank follows soft as well as hard recovery measures for recovery in default accounts;

Soft Recovery Measures:

- Reminder notice and regular visits.

- Recovery camps during harvesting season.

- Pressurizing borrowers through village sarpanch/elders.

Hard Recovery Measures:

After rigorous follow ups, if the borrower is still adamant in repayment of loan then bank initiates following recovery measures:

- Recalling of advance: Loan recall notice is issued to borrower advising for immediate repayment of complete outstanding amount within 15 days of issue of notice. If failed to do so, bank may initiate SARFAESI action or suit filing as applicable.

- SARFAESI: Provisions of SARFAESI Act 2002 is initiated as applicable. However SARFAESI is not applicable in Kisan Credit Card loans.

- Suit filing: Suit is filed through bank’s empaneled advocate.

CONCLUSION

Kisan Credit card is the most sought loan by farmers in India. It is a practical solution to the financial crunch faced by farmers. I have tried to address all the common and uncommon doubts anyone could have while availing a Kisan Credit Card. Still have a doubt? Feel free to drop a message. You may also refer RBI’s mater circular on KCC.

You might be interested in reading this post as well: Can I keep cash/gold in my bank locker? , Insider’s Guide: Top 06 Cryptocurrencies to Watch in 2024