Gold loans are very popular and one of the most sought-after loans in India. The best part about Gold loans is that they require no extensive documentation and credit checks. In this cutting-edge era of competition among banks, Gold loans are the favourite product for all. Banks offer attractive rates, hassle-free documentation options, and, most importantly, disbursement in less than an hour.

In this blog, we will discuss in detail the intricacies of gold loans, types, features, repayment options, and much more.

What are Gold Loans?

Gold loans are taken to immediately or urgently meet an individual’s financial obligations. The bank does not ask for the end use of the funds. The Gold is taken as a pledge against the loan. Usually, banks consider only 22-carat Gold; however, some NBFCs consider 18-carat Gold as well. It is secured loan as loan is backed by Gold as collateral.

How do Gold Loan Works?

Gold loans work on a straightforward principle: you pledge your Gold to the bank, and in return, the bank provides you funds based on the valuation of the Gold. Usually, banks accept 22-carat hallmarked Gold, and if the Gold is less than 22 carats, say 21-carat or 20-carat, then normalization is done, and its value is converted to 22 carats. For example, if the purity of Gold is 21 carat and the net weight of the Gold is 100 grams, then the value (21*100/22)=95.45 grams is taken into consideration for loan.

However, as an applicant, you need not worry about the carat, as the bank’s appointed appraiser will check the same. Based on his analysis, he will derive the net weight of the Gold after excluding the weight of any stones, diamonds, gems, impurities, etc. from the gross weight. Gold with a higher carat value is considered pure, and chances are that the loan amount will also be higher for such high-carat golds.

The net weight of the Gold is now multiplied by the bank’s rate as per the scale of finance. As the price of Gold fluctuates daily, all banks follow a thumb rule set by the RBI that says the lender must calculate the average of the gold prices in the last 30 days to determine the gold valuation for a gold loan on a particular day. So, lenders decide the gold price per gram on a fortnightly or monthly basis.

Let’s understand this by an illustration: As per a bank’s scale of finance on a particular day, it will lend INR 5000/gram or 75% of the market value of the Gold. Now, if a customer has 30 grams (Gross weight) of Gold, the bank’s appraiser will inspect the Gold, and let’s say after excluding stones, impurities, etc., the net weight arrives at 20 grams only.

Multiplying 20 grams * 5000 (Bank’s lending Rate) = INR 1,00,000/-

In this scenario, the bank will lend INR 1,00,000/- to the customer.

Is it safe?

Gold kept as collateral is the bank’s responsibility. Therefore, it is kept in a safe vault specially designed for gold keeping. The bank is 100% liable to pay the market value of the Gold in case of theft or loss, unlike gold kept in the locker, for which the bank only bears 100 times the locker fee. For detailed understanding please refer locker rules here.

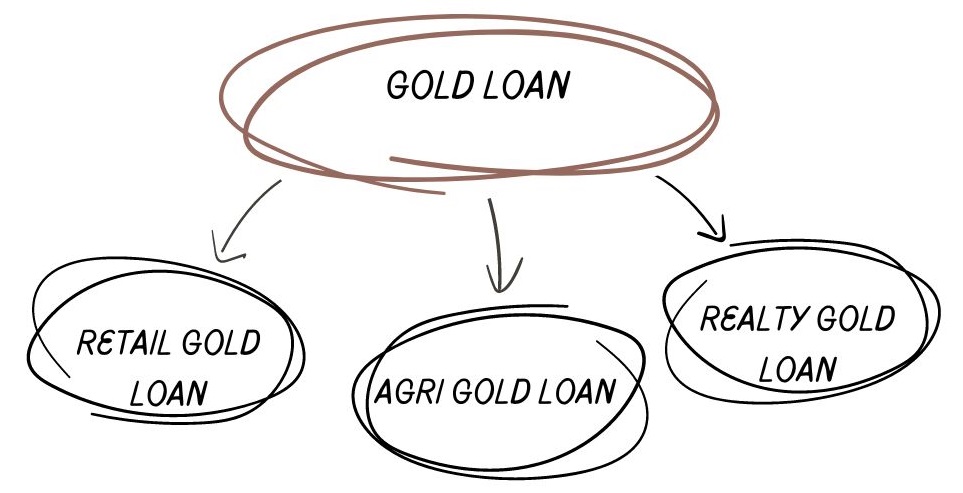

Types of Gold Loans

Banks offer different types of Gold loans for different clientele. Broadly let’s divide them in three segment;

- Retail Gold Loans: These gold loans are available to any individual to cater to his personal or business obligations.

- Agri Gold Loans: The target customers for these loans are farmers or individuals involved in agri-allied activities.

- Kisan Credit Card (KCC) Against Gold Loan: Kisan Credit Card is a cash credit facility that is given to farmers to meet their short-term financial needs in cultivation and ancillary activities. Farmers have both option to to keep land or gold as collateral.

- Realty Gold Loans: Some banks, like SBI, offer this type of loan to their existing housing loan borrowers to meet any financial shortfall in securing housing property.

Eligibility Check & Type of Credit facilities

Age Limit

- Min Age: 18 years

- Max Age: 70 Years

Credit Facilities

- Term loan

- Cash Credit

Documents Required for Gold Loan

Typically, the documents required for a gold loan are;

- Proof of identity

- Address Proof

- Agriculture land ownership like 7/12 extract (only in case of Agri Gold Loan)

Margin and LTV for Gold loans

Margin: As per RBI guidelines, a minimum haircut of 10% is required, allowing banks to finance 90% of the value of the Gold.

Loan to value (LTV): It is one of the safest secured loans for banks because the loan-to-value ratio varies between 55% and 65%, providing banks with a cushion of 35% to 45%. The LTV in a Gold loan is less than that of another secured loan due to the fact that its value fluctuates on a daily basis.

Payment Options for Gold Loan

- Monthly interest payment: Only interest is paid on monthly basis and the principle amount is paid at the end of the loan.

- Bullet repayment: In this type of repayment, interest and principle both are paid at the end of tenure of the loan.

- Principle Equally Distributed: PED is used if the customer wants to pay the interest and principal equally. As the principal amount declines the interest accrued also declines.

- Equated Monthly Installments (EMI): EMI facility allows customer to make repayment of a fixed amount which include interest and principal in certain proportion for a particular period.

Standard Features of Gold Loan

- Loan amount based on the value of gold. Individual can avail up to INR 25.00 lacs instantly.

- Flexible repayment options: monthly interest, bullet repayment, pre-EMI, or EMI

- Quick disbursal with minimal documentation

- Competitive interest rates

- No credit history required

- No end use verification

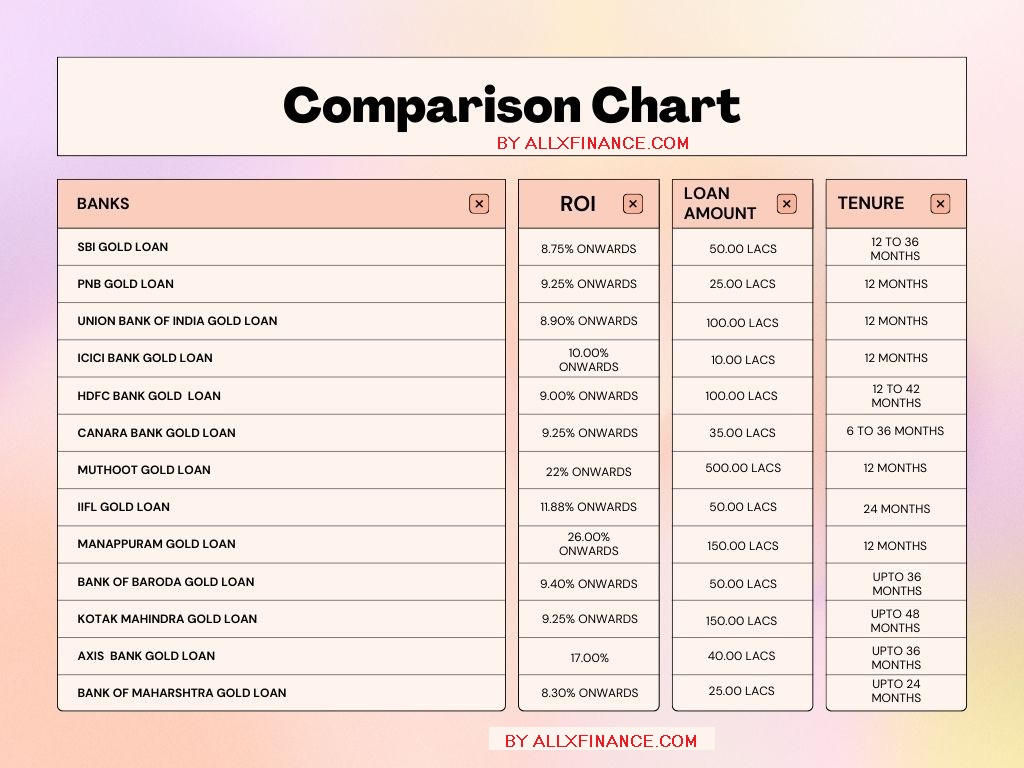

Gold Loan Interest Rate Comparison of Top Banks

Interest rates on gold loans vary among different banks and financial institutions. I have compared the rates offered by all major banks dealing with gold loans.

Repayment and Impact on Credit Score

- Like every other loan, Gold loan repayment works in a similar fashion. Be it any type of repayment mode (Monthly Interest/PED/EMI), default in payment definitely affects creditworthiness, whereas timely payment increases the CIBIL Score.

Advantages and Disadvantages of Gold Loan

Advantages

Disadvantages

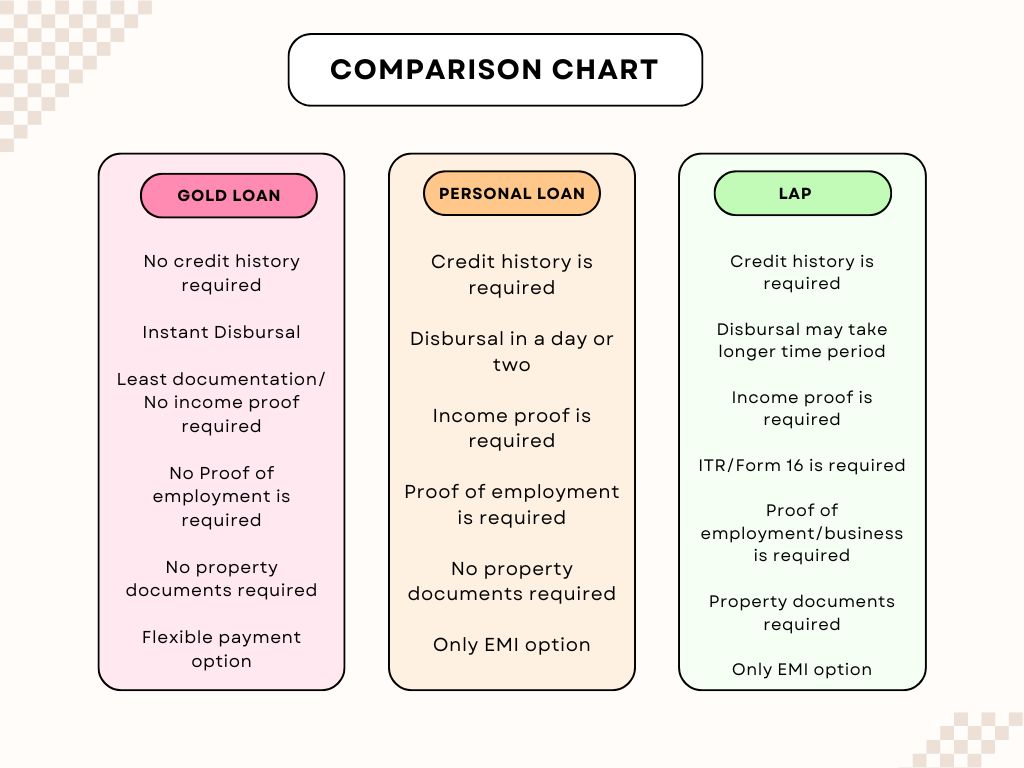

Gold Loan vs Personal Loan vs Loan Against Property

Recovery Procedure in default Gold loans

If the Borrower defaults on the loan’s interest payment, the Bank has full power to sell the pledged Gold only through public auction and recover the bank dues. Initiating the recovery process, the Bank issues a demand or notice to the Borrower by sending the same at the last known address as per the Bank’s record. If the dues are still not clear, then the Bank is left with no other option but to auction the pledged Gold to recover its dues.

Other FAQs

Common doubts people might still have, I am trying to answer in this FAQ section.

Conclusion

Gold loans are the best option when it comes to fastest possible disbursement. Within an hour , the borrower can avail the the funds. Best part is the funds can be used to fulfill personal or business demand. bank never asks the end use of funds. However it is advised to timely repay the loan as per the terms and conditions and carefully use the availed funds.

You might also want to read; Mudra Loans: Top 11 doubts busted ; Cryptocurrency Insider’s Guide: Top 06 coins to follow in 2024