Crypto has been a hot topic ever since it was launched. We all want to invest in cryptocurrency, but lack of experience and knowledge defy us. Before we get into any technicalities of crypto, let us understand why there is so much hype around them.

It all started with a pseudonymous name, “Satoshi Nakamoto”. He was the one who presented the idea of a digital currency in 2009. The basic idea of having a digital currency is beyond the control of any government, country or central bank.

The first digital currency was BITCOIN, created by the pseudonymous “Satoshi Nakamoto”. It has undergone growth, de-growth, market crashes and whatnot. Anyhow, we are in 2024, and crypto is undoubtedly now considered one of the stable assets for investment.

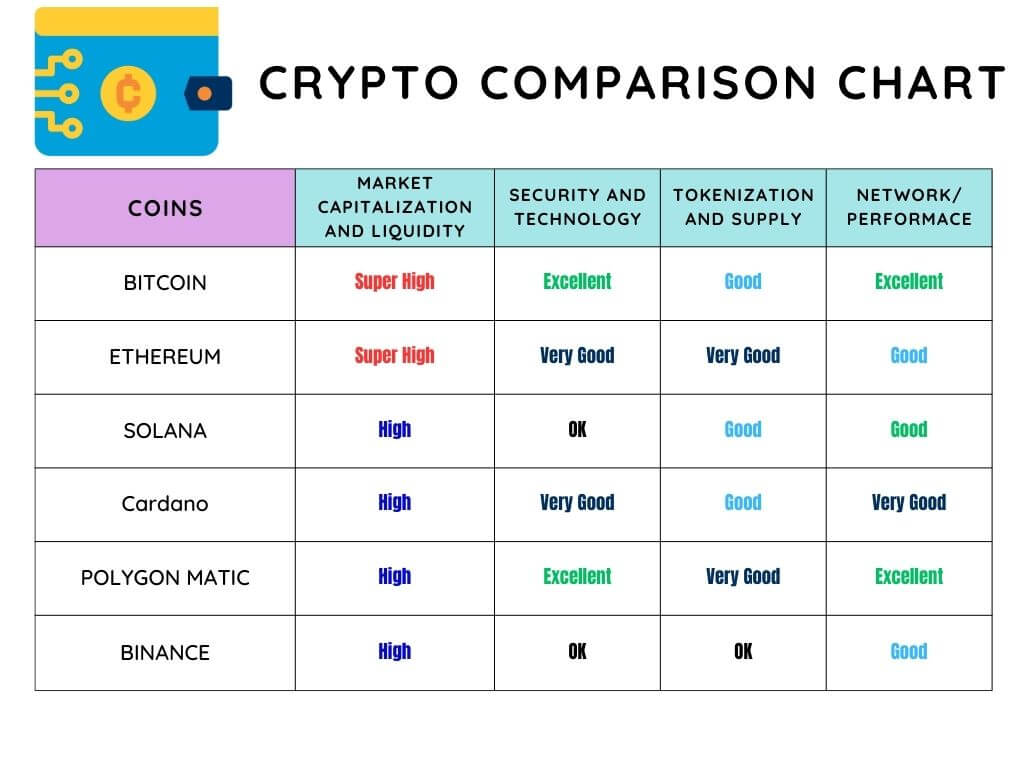

No worries if you are a newbie or a Cryptocurrency enthusiast, we will not let you miss the next big thing. In this blog, we will discuss the TOP 06 Crypto’s which are worth time and money both. All the cryptos has some unique feature over others. Which one you choose to invest is totally a personal choice. We have chosen to write on these cryptos considering parameters like;

Top 07 Cryptocurrency to put on your watchlist in 2024

- BITCOIN: The very first cryptocurrency has broken records ever since it was launched in 2009. Still holding the number one position on the charts. Bitcoin has the largest market capitalization with excellent liquidity. It seems Bitcoin will maintain its top position for years unless another winner arises from the dark end of the street. Technically, Bitcoin is very sound and uses blockchain technology. In short, blockchain technology is a method of storing financial transactions in a way that cannot be modified, hacked, or manipulated.

Pros

Cons

2. ETHEREUM: This one is the second coin ruling the charts. Initially launched in the year 2013 by Vitalik Buterin. It works on the decentralized blockchain with smart contract functionality. Meaning it was basically designed to be a decentralized platform for the development of DApps. Automatic smart contracts are created, enabling all the terms and conditions to be written in the form of code. Developer can use the Ethereum platform to create a range of Dapps, apart from simple currency transfers.

Pros

Cons

3. SOLANA: This is another blockchain platform similar to Ethereum, designed for decentralized applications (DApps). Initially founded as an open-source project in 2017. Its native crypto is SOL, used for transactions. It is based on two mechanisms: proof-of-history (PoH) and proof-of-stake (PoS).

Pros

Cons

4. CARDANO: This one is another blockchain platform based on the concept of Ethereum. However, it is designed with more advanced features and flexibility. Like other platforms, this also allows the development of DApps and smart contracts. It’s native cryptocurrency is ADA. Cardano pitches itself as the most environmentally sustainable blockchain platform.

Pros

Cons

5. POLYGON MATIC: Polygon Matic was formerly known as Matic Network. This architecture is used for building and connecting Ethereum-compatible blockchain networks. What makes it different from others is that it is highly scalable and interoperable for building decentralized applications (dApps). The best part for developers is that it allows them to build and deploy Ethereum-compatible dApps on the Polygon network.

Pros

Cons

6. BINANCE: In Dec 2023, India banned many crypto exchanges, including Binance. Binance is a cryptocurrency which cannot be ignored, even if it’s prohibited in INDIA. Even if we exclude India, Its market capitalization is enormous. Therefore, it is advised to investors from INDIA to refrain from investing in any exchange which is directly on the regulator’s hit list.

Are Cryptocurrency legal in INDIA?

As per RBI, crypto is not considered a legal tender. As per their circular in 2017, RBI advised investors to refrain from investing or holding cryptocurrency. However, in 2020, a landmark judgment came from the Supreme Court of INDIA, which quashed the RBI circular, stating it was unconstitutional. Since then, investment and holding crypto has been allowed in INDIA.

Is Cryptocurrency income taxable in INDIA?

As per Income tax, the income from investment/holding of cryptocurrencies is subject to 30% (plus 4% cess). An additional TDS of 1% is levied as per section 194S if the transaction exceeds INR 50,000/-.

Conclusion

All the coins listed above may have a plus or minus and may differ as per personal choices and opinions. The list may not seem exhaustive, however I have chosen the coins based on their current market reputation. I am always open to discuss more on this. Feel free to connect through contact us page.

Disclaimer

Cryptocurrency investments carry risks, and it’s crucial to make informed decisions based on their own financial situation and research. This blog on crypto is for informational purposes only. Please seek personalized investment advice from investment advisors.

You might want to consider Busting Term Insurance doubts: Revealing Top 05 Term Insurance Plans! ; Personal Loan, clear your 100% doubts!