Recently, I planned to buy a term insurance for myself and while I was doing the necessary research, I realized that there are so many options available in the market. It is possible for anyone to get confused going through the comparison websites like policybazar.com and insurancedekho.com.

I felt the need to make things simple for people looking for a term insurance. I will start from the very basics of term insurance and by the end you will be able to choose a term insurance plan for yourself. Don’t worry, if choosing one policy is still a task, I will recommend top 05 insurance available in the market. I will do the research for you and recommend you handpicked term insurance plans which fits for any age group. Of course, I will take due consideration of income criteria , protection coverage etc. is also taken care of.

What is Term Insurance?

As the name suggests term insurance gives you cover for particular period. If the policy holder lives till the end of policy term, nothing is paid. But the policy holder dies, nominee gets the insured amount. If the policy holder opts for return of premium, then the insurance company returns all the premium paid post completion of tenure of the policy. Premium is a bit higher if return option is taken.

Difference between Term Insurance and Life Insurance!

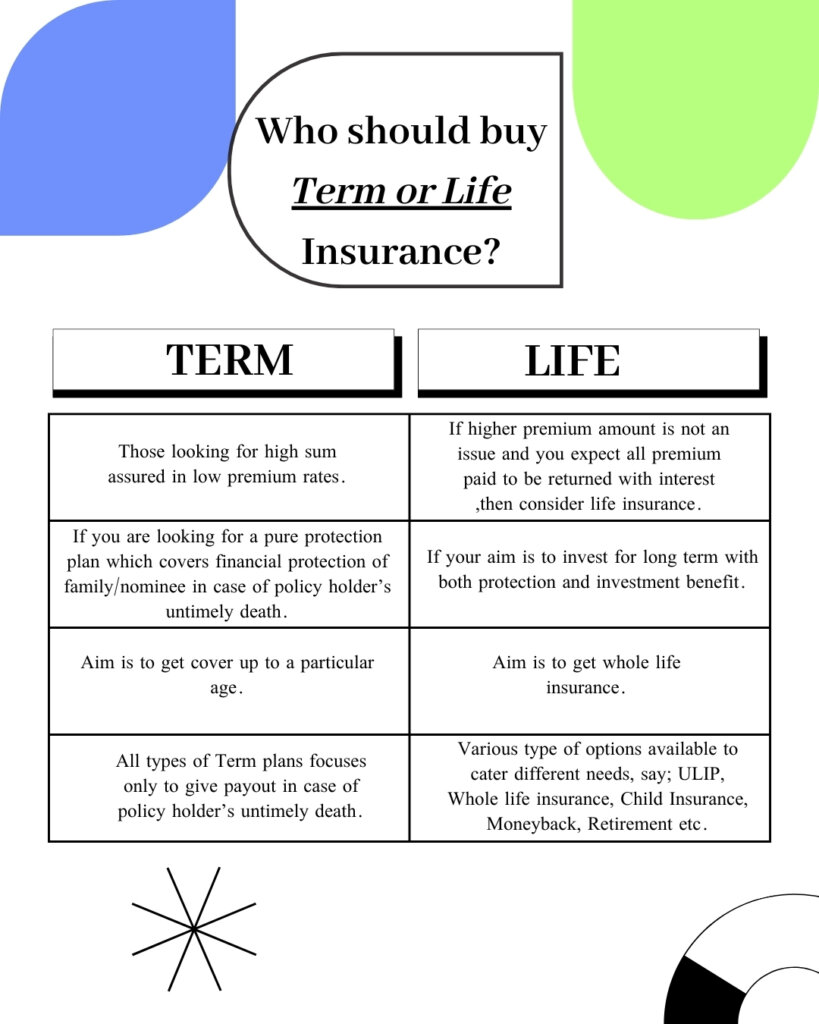

Well, the difference lies in the benefit both type of insurance carries with itself. The benefit of term insurance comes when the policy holder is gone. Whereas, the life insurance covers life with a cash value component. Don’t get confused, lets understand it this way;

Mr. X is the sole bread earner of his family. He wants to have a policy, to secure his family from financial burden, in his absence. Now, he wants a insurance plan that would give a hefty amount (say 1 crore) to his wife, in case of his untimely demise. His present age is 30 and he plans to cover his life till retirement say up to 60 years. In this scenario, term insurance for 30 years with a very minimum annual premium will fulfil his requirement.

Lets take another scenario, where Mr. X wants to have a policy which will cover his life and at the end he receives all the premiums paid with an interest. Then he should go for a life insurance plan. Life insurance plans are made to look fancy with additional benefits of return of investment apart from protection. But the catch is, the buyer pays so much higher premium in life insurance plans as compared to term insurance. The sum assured is also very less as compared to term insurance.

So, the basic requirement should be clear in mind before choosing any of them. In my view, investment and insurance should never be mixed. They are not meant to be together but it is sold with fancy return promises to layman.

Which is better Term Insurance and Life Insurance?

There is no good or bad in choosing any of them. Both come with benefits, and it is up to the individual to understand his needs and select any of them.

Practically nobody thinks they are going to die any sooner, but that’s the reality. Ideally, both types of insurance should be taken if affordability is not an issue. But if budgetary constraints are there, then a Term Plan is mandatory.

How Much Term Insurance do I need?

Well, we have a thumb rule to calculate the ideal insurance an individual needs. Industry experts and so-called financial advisors follow this thumb rule. So, the method is to get coverage of at least ten times your annual income. Let’s say your annual income is 15 lacs. Then, the ideal cover, as per this rule of thumb, should be 1.5 crore. This method is acceptable due to its simple calculation.

However, there is a better way to calculate the exact amount of coverage you need. It would be best to calculate all your present expenses, including monthly bills, EMIs, and monthly savings required to meet future goals like children’s education, marriage, etc. This is the final amount you need to cover all present expenses. However, we need to use the projection method to calculate the costs when you are 60 years old.

For example, Amit, aged 30 years, wants to derive the exact amount of term insurance coverage he should buy. To do so, he will need to calculate current monthly expenses ;

Monthly in hand Salary: 1,00,000/-

Current Monthly EMI: 20,000/-

Household Expense: 15,000/- (Grocery and all)

Children Education Fees: 10,000/-

Utilities: 5,000/- (Water/Electricity/Internet)

Vehicle/Transportation: 10,000/-

Bills: 5,000/-

Saving: 20,000/- (SIP/RD, etc., to meet future expenses)

Insurance Premium: 30,000/- per annum (So monthly is 2500/-)

Total is: 87,500/- (Rs 10.50 lacs annually)

Going by the thumb rule, ten times the present annual income, 1.10 crore coverage is needed. This is the minimum coverage Amit needs for his family. But it may not be sufficient if we consider factors like inflation and rise in future expenses. So, let us add a buffer of 20% for an increase in expenses and inflation of 5%, i.e., 25% for every 05 years. By doing so, we see the calculation as;

At age 30: Rs 1.10 crore needed

At age 35: Rs 1.37 crore needed

At age 40: Rs 1.71 crore needed

At age 45: Rs 2.14 crore needed

At age 50: Rs 2.68 crore needed

At age 55: Rs 3.35crore needed

At age 60: Rs 4.19 crore needed

This method is called Expense Replacement. So, Amit should get a cover of Rs 4.19 crore to meet his family’s present and estimated future expenses.

Why medical test in Term Insurance?

Medical tests are crucial for insurance companies to cross-check the health information provided by the applicant. In addition, it helps the insurer to calculate the premium for the coverage offered. Lower is the premium if medical reports confirm no major health issues. And for any underlying illness, the insurer may increase the premium of the plan.

Can Term Insurance be ported from one company to other?

According to IRDAI, the regulator of insurance companies, only health plans can be ported. Term plans are not allowed to be ported.

Why claims under Term Insurance are rejected?

Does Term Insurance cover terminal illness like Cancer/AIDS?

Terminal illnesses are those that eventually lead to death due to the lack of a precise cure. Well, we do have the option to cover such illnesses by adding a Terminal illness rider with term insurance. Of course, the premium will increase with the addition of any sort of rider. The terminal illness rider ensures 50% payment on detection to meet the forthcoming expenses of treatment. The remaining 50% is paid to the nominee post-demise of the policyholder.

Can Term Insurance be cancelled anytime?

Any insurance can be canceled in between the free look period, i.e., 15/30 days from the day of the first premium payment. During this period, the policy can be canceled without any surrender charges. Refund is initiated post initiation of cancellation within the said period.

Apart from this, term insurance can be canceled at any time by stopping the payment of the premium. The policy will automatically go into a lapse state.

Top 05 Term Insurance, which is almost perfect for anyone!

- HDFC Life Click to Protect Super

- Max Life Smart Secure Plus

- Bajaj Allianz Life e-Touch (Life Shield Plus)

- TATA AIA SRS Vitality Protect

- ICICI Prudential iProtect Smart

*The order does not matter as all comes with some plus and minus features.

After thoroughly examining almost fifteen plans which are best rated, I have finalized the best five. These five plans have been chosen based on factors like;

Let’s us understand these five factors to know why these are important? First of all , the claim settlement ratio is the number of claims settled by a company in a year. Higher number of solvency ratio is considered good in terms of claims settlement. As per IRDA, the ideal ratio for solvency of a insurance company is 1.5. It is the capacity for payment of claims from the corpus available with insurance company. Then comes the company’s annual turnover which shows its business size. This will help us in choosing a company which will easily survive for another 30/40 years.

Then comes the add-ons which are highly recommended to have in a term plan. All add-on benefits are included in the below listed five policies;

- Waiver of premium in case of any disability: In case of any disability all future premiums are waived.

- 100% payout in Terminal illness: In case of any terminal illness is detected at any stage, the 100% amount of the life covered is paid immediately, instead of being paid at death of policy holder. amount is paid.

- Critical illness cover: This add on ensures an extra payout in case any critical illness is detected.

- Accidental death benefit: This add on ensures an extra payout to family in case of accidental death.

Conclusion

The whole idea of this blog is to give in depth idea on term insurance. I have tried to address all the common doubts. Term Insurance is a must thing to have, so I have narrowed your search for the best ones. Still have anything to ask, please feel free to connect through contact us page.

You might also want to read Maximizing Your Travel Experience: Best Credit Cards with Lounge Access in April 2024! ; 100% Understanding the PMFME; Pradhan Mantri Formalization of Micro Food Processing Enterprises Scheme