Under the wings of ATMA NIRBHAR BHARAT, the MINISTRY OF FOOD PROCESSING INDUSTRIES has launched a scheme to formalize the micro food industry. The PMFME scheme provides a golden opportunity for micro food entrepreneurs (individuals), FPOs/ SHGs/ Co-operatives to expand and mechanize the processing of food item production.

The food processing industry in India is majorly unorganized, but it still contributes to a large percentage of employment. The majority of them are located in rural parts of INDIA.

The formalization of the food industry will not only boost employment in the sector but will shift the industry from manual to automatic by providing the required machinery to the beneficiaries.

Who are eligible Borrowers for the scheme?

Key objective of the PMFME Scheme

#One District One Product Approach: As the name suggests, the One District One Product (ODOP) is to ensure that the food product with the highest production in the district is highlighted through the proper channel. The required support, like branding and marketing, will be provided to the producers under this approach. The authority to decide on a food product for the district vests with the state. There could be one cluster of ODOP products in one district or maybe a cluster of ODOP products consisting of more than one adjacent district of the state. Food products may include perishable agricultural produce, cereal-based products, or any other food product with maximum production in the district.

#Upgradation of existing/new micro food processing unit: Individuals/micro food processing units can benefit from the scheme by receiving financial assistance to upgrade their technology. Or may take assistance to set up a new food processing unit.

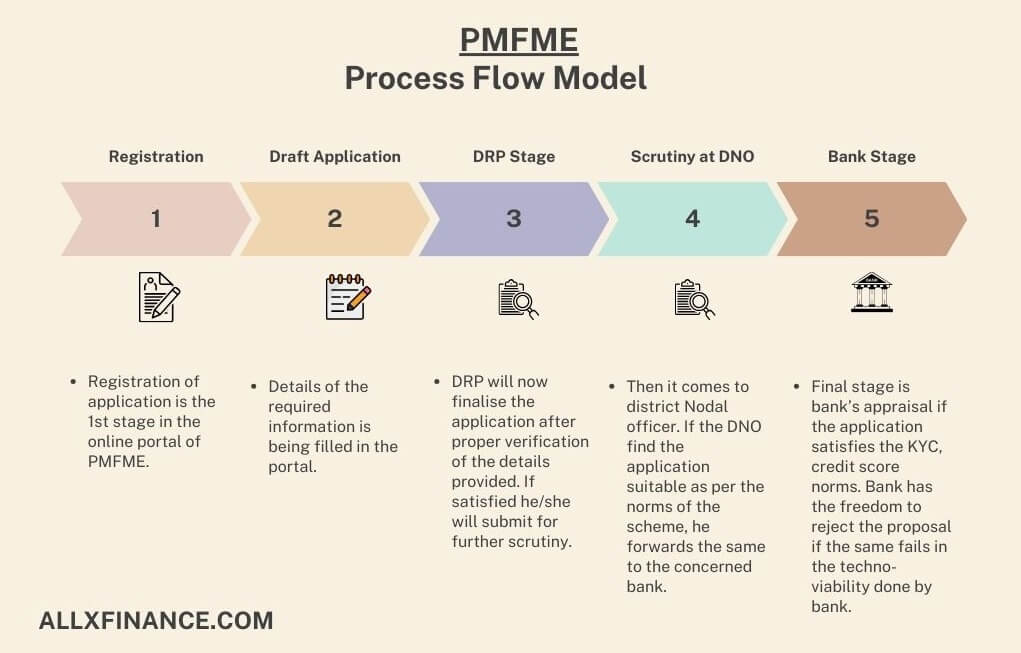

- Financial Assistance with credit-linked subsidy: A credit-linked subsidy of 35% for expansion or new setup with an upper ceiling of Rs 10.00 lacs per unit/person. The loan will be shared as the borrower’s 10% margin money contribution, and the remaining 90% will be a bank loan. For example, If a person wants to set up a paneer-making machine or Papad-making machine, he may approach the DRP (District Resource person) available at the block level. With Assistance from the DRP, the application may be forwarded through the online portal for district-level committee approval. After the approval from the committee, the application is sent to the banks. Then, banks will do their due diligence on the application. They will check the applicant’s credit history (CIBIL Score) and may visit the applicant’s house as well. The loan is processed if the bank finds the application suitable for lending.

- Capacity Building: The scheme has a provision to provide certificate-based training to needy individuals to enhance their knowledge in terms of production, packaging and marketing of their product. The training makes them capable enough to run their micro-processing unit successfully.

- Focus Areas: Entrepreneurship development and specific product designed for ODOP products.

#Support to FPOs/SHGs/Producer Cooperatives: The scheme would support groups like FPOs/SHGs in the entire procedure, beginning from sorting, processing, packaging, and marketing to lab testing of the agricultural produce.

#Seed capital To SHG: SHGs would be provided with Seed capital @ Rs40,000/- per member of SHG for working capital and purchase of small tools. Those producing as per the ODOP approach will be given preference.

#Common Infrastructure Development: The FPOs, Farmer Producer Company (FPC), Cooperatives, SHGs and their subsidiaries, private enterprises and government agencies are advised to develop a common infrastructure under the scheme. This may include a cold storage, warehouse, Incubation Centre etc.

The eligibility for financing infrastructure developments is decided on many factors;

- Credit history of the group members.

- Project’s viability gap; Means feasibility or sustainability of the project to market scenarios. It should not turn into loss making in future.

- Absence of private investments; why private entity is not interested in the project?

- The importance of project outcome to value chain system; Means if it will be of any value to the industry by generating employment, fulfilling the demand of market with its product.

Salient Features of the scheme

List of food items not covered under PMFME Scheme

Process flow of PMFME Scheme

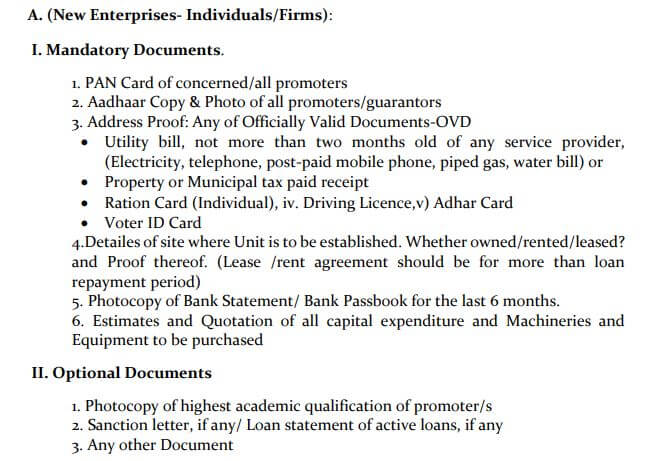

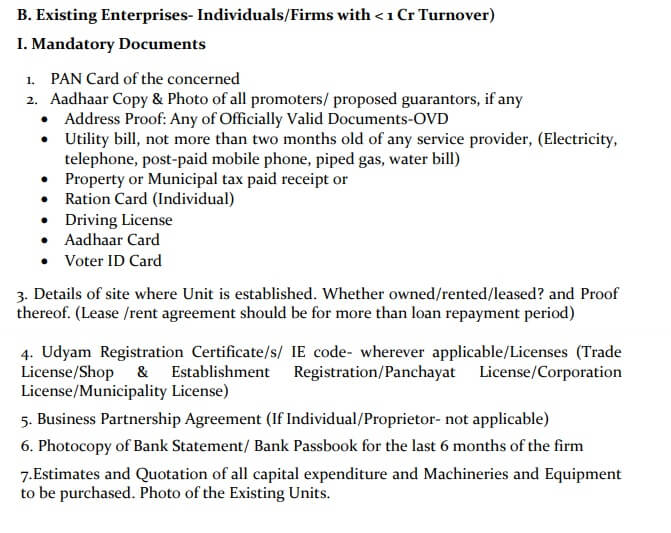

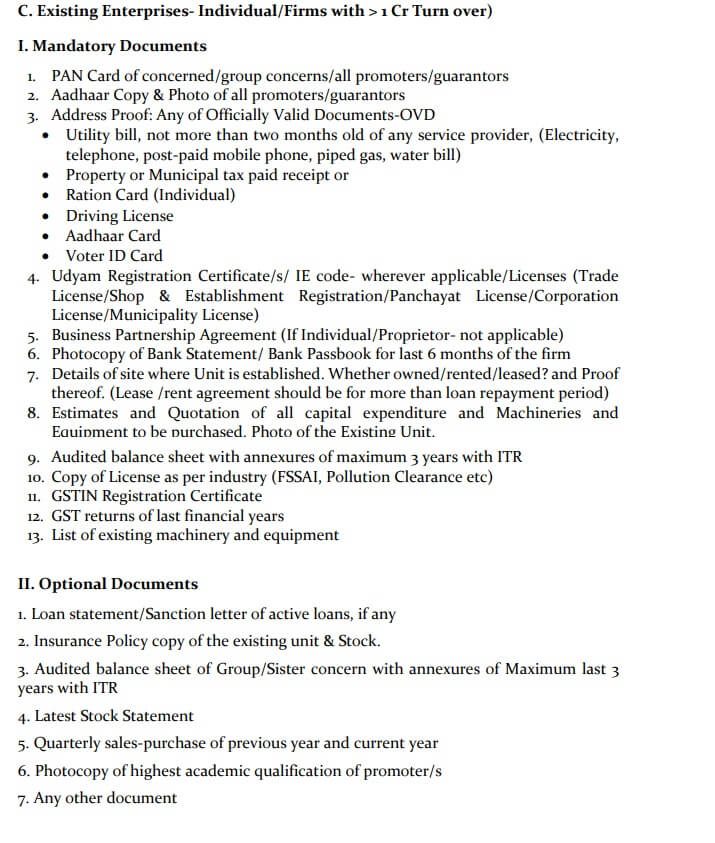

Document Checklist

Conclusion

The emphasis of the scheme is on the agri-food producers at the grassroots level by providing them with an opportunity to become entrepreneurs in the food producer ecosystem. In a nutshell, the scheme will provide a livelihood to many individuals and foster economic growth and resilience.

For individuals, it is an opportunity when government agencies and banks are jointly encouraging individuals/groups by paving the way to food-business entrepreneurship. From a loan bank’s perspective, the PMFME scheme is a readily available business. It is a win-win situation for both customers and banks.

You might want to read Can I keep cash/gold in my bank locker? ; Busting Term Insurance doubts: Revealing Top 05 Term Insurance Plans!